Contents:

Experienced traders will sometimes trade within these trading ranges, which are also known as sideways trends. One strategy that they use is to place short trades as the price touches the upper trendline and long trades as price reverses to touch the lower trendline. This strategy is extremely dangerous, and it is much better to wait to see in which direction price will break out of the range and then place your trades in that direction. Support and resistance (“S/R”) is part of the foundation of technical analysis. Think about trends which are a series of rising support levels or lowering resistance levels.

- //Combining small candles to get larger candles of required timeframe.

- Bounce off – There needs to be a visible departure from the horizontal line which is perceived to define the level of support or resistance.

- In this article, I’ll refer to key levels as price levels, but there are some traders saying that key levels are areas, not levels.

To establish the strength of the support and resistance lines, you can combine these methods. These are by no means perfect but seem to reflect areas in which price action has reversed on several occasions. Finding more appropriate boundary lines can be approached by using different cluster values. This isn’t an article on k-means clustering and glazes over the technical details.

The actual high has been higher than R1 853 times, or 42% of the time. The actual low has been lower than S1 892 times, or 44% of the time.

As you can see, we have been able to detect the major rejection levels, but there’s still some noise. Some levels are over others, but they are essentially the same level. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. Resistance occurs where an uptrend is expected to pause temporarily, due to a concentration of supply. Support occurs where a downtrend is expected to pause due to a concentration of demand.

A https://traderoom.info/ concept in technical analysis is that support often turns into resistance when the price breaks it – its ‘role’ is reversed. You can identify potential entry and exit points in your trades by monitoring overbought and oversold levels. For example, if an asset is approaching a support level and is oversold, it could be a good opportunity to buy, anticipating a price reversal. You will have all support/resistance values with a strength.

How to draw Support & Resistance Level in a chart?

Before you place the trade, consider your profit target and what you consider to be an acceptable level of loss, then decide on your exit points near the support and resistance levels. If you are using trend lines, make sure you have at least three peaks or three troughs before you draw your lines, so that you have a useable trend line. Then, once you’ve plotted the trendlines onto your chart, your uptrend line will be the support level, while the donwtrend line will be the resistance level. As with moving average support and resistance levels, these levels are dynamic. The moving average indicator is another way to identify support and resistance levels, and draw them on a chart.

The slope error is sufficient indicator of the error so this will be applied. It should be noted the SSR, slope and intercept error are assuming that the variance of the points is constant which may not be the case. So since the variance is not guaranteed nor is a normal distribution, why even use anything derived from the SSR? Since we are not hypothesizing about the distribution but merely comparing the error values to a fixed percentage error, our use case makes the slope error sufficient for selection. The SSR can still be kept as it could also be adapted for the same purpose although with very similar results. However, doing a simple straight average of the expected values verse the actual values is the simplest and still acceptable.

Determining the Right Number of Clusters

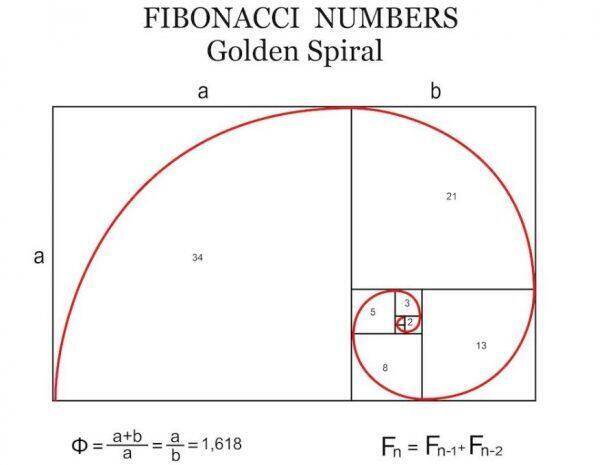

And finally, to conclude this brief introduction to chart analysis on the MetaTrader 4 platform, let’s see how to use and draw Fibonacci retracements on the chart. The Fibonacci tool is used to find price-levels where a “higher low” may form during an uptrend, or a “lower high” during a downtrend. In this article, I’ll cover an algorithm to automatically detect two important tools of price action, which are supports and resistances. Technical analysis is one approach of attempting to determine the future price of a security or market. Some investors may use fundamental analysis and technical analysis together; they’ll use fundamental analysis to determine what to buy and technical analysis to determine when to buy.

The Hough transform is quite straight forward to implement in Python optimized as a point input algorithm. For all angles and all points, the distance to a line perpendicular to the angle which falls through the point is calculated. For each angle, the distance to this perpendicular line is accumulates a point, where different points with identical distances by geometry must lie on a straight line. In fact a lot of matches with 3 points are immediately replaced by 4 or even more points as unsurprisingly trends do occur in real security or index data. This is an approximation algorithm and not exhaustive since sorting by slope is not a guarantee that neighboring slope values will have best fits when there could be great distances between points.

Materials and Methods

Conceptually, this one would represent a resistance line for prices in cluster 1 and a support line for prices in cluster 2. Next up, we’ll teach you the various ways in which you can incorporate pivot points into your forex trading strategy. The forex pivot point calculator can come in handy, especially if you want to do a little backtesting to see how pivot point levels have held up in the past. Keep in mind that some forex charting software plots intermediate levels or mid-point levels. You can best find strong support and resistance by looking for areas where the price has historically bounced convincingly and moved a large distance. If the price bounces off a level significantly, for example, it retraces hundreds of pips on a daily chart, I consider that a significant level even if it is one bounce.

Support and resistance can be found in all charting time periods; daily, weekly, monthly. Traders also find support and resistance in smaller time frames like one-minute and five-minute charts. But the longer the time period, the more significant the support or resistance. To identify support or resistance, you have to look back at the chart to find a significant pause in a price decline or rise. Then look forward to see whether a price halts and/or reverses as it approaches that level. As has been noted above, many experienced traders will pay attention to past support or resistance levels and place traders in anticipation of a future similar reaction at these levels.

What is Support and Resistance in reference to stocks?

Camarilla pivot points are a set of eight very probable levels which resemble support and resistance values for a current trend. The most important is that these pivot points work for all traders and help in setting the right stop-loss and profit-target orders. Determine significant daily, weekly, and monthly support and resistance levels with the help of pivot points. To learn more about how they work, check out our Pivot Points lesson. As prices move higher, there will come a point when selling will overwhelm the desire to buy.

DIAMEDICA THERAPEUTICS INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K) – Marketscreener.com

DIAMEDICA THERAPEUTICS INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-K).

Posted: Tue, 28 Mar 2023 20:35:14 GMT [source]

Integrating support and resistance levels into your predictive model can help better anticipate price reversals. Here we take a deep dive into how KMeans clustering might be applied to achieve such a goal. You can see support and resistance levels on candlestick charts, bar charts, and line charts. Use line charts only for higher timeframes—daily and above. The other support and resistance lines chose only semi-prominent peaks and are legitimate per definition of trend line, but hardly what would be considered useful. So the best trend lines with lowest error, are not necessarily the best support and resistance lines.

These are basically mini levels between the main pivot point and support and resistance levels. S/R levels are found in chart patterns, particularly head and shoulders reversals. When price tests the ‘neckline’ of a head & shoulder pattern, it can provide an excellent trade entry. Identifying support and resistance on a chart depends on the timeframe I am looking at. I may spot an S/R level on an hourly chart, but it could be too small to see on a daily chart. Usually, higher time frame levels are stronger than lower time frame levels.

The three or more point requirement is where almost all trivial attempts fall short. So we will discuss the technical details behind each aspect of implementing this. This interesting topic will be saved for future discussion. In my trading journey, I’ve found pivot points to be quite useful, especially when combined with other technical indicators. They can serve as a reference point for your trading strategy and help you make better decisions in the fast-paced world of trading.

Of course at least 2 points must have been identified to fit this line. There are two standard errors given as one is the error of the slope, the other of the intercept. The intercept error is the slope error adjusted by the x values.

This, in turn, creates demand and helps push the price back up. These support/resistance were calculated considering support levels search. You need perform steps 2 to 9 considering resistance levels search. MetaTrader 4 is one of the most popular trading platforms among retail Forex traders which features advanced charting tools to identify important market turning points.

- The statistics indicate that the calculated pivot points of S1 and R1 are a decent gauge for the actual high and low of the trading day.

- I use support and resistance to trade Forex and other markets—stocks, futures, crypto, etc.

- The concept of support and resistance levels acts as a foundation for many advanced trading strategies, which is why you need to understand these concepts as early in your trading career as possible.

- Conversely, when the price approaches a resistance level, it might be a good time to enter a short position or close a long position.

Finally dividing it by the number of days gives a measure of the wrong side of the trend per day and the best trend lines can be selected. From my experience, support levels often act as psychological barriers preventing the price from dropping. When the market approaches a support level, many traders will enter long positions , anticipating a price increase.

Customers must also be aware of, and prepared to comply with, the margin rules applicable to calculating support and resistance levels trading. Day trading is subject to significant risks and is not suitable for all investors. Any active trading strategy will result in higher trading costs than a strategy that involves fewer transactions. All investing involves risk, including loss of principal invested.

In practical terms this could be computed by iterating over your smoothed closing price series and looking at three adjacent points. If the points are lower/higher/lower in relative terms then you have a maxima, else higher/lower/higher you have a minima. You may wish to fine-tune this detection method to look at more points and only trigger if the edge points are a certain % away from the centre point. This is similar to the algorithm that the ZigZag indicator uses. Usually, prices which lay in between the 38.2% and 61.8% Fibonacci retracement lines can act as a support zone for the price, i.e. the price can retrace anywhere between those two levels. Another rule of thumb is that, once a resistance level is broken, it automatically becomes a support level.