Contents:

Take note that in the two examples we discussed, the trend line breakout appeared at different times in the process. In the first case the price broke the trend after the creation of the second top. In the second case the trend breakout came right after the creation of the first bottom.

More importantly they work well in actual testing, providing stops that are not too tight, yet not so wide as to become prohibitively costly. This creates a high between the two lows , and the neckline is defined as a vertical line drawn on top of this high. A double bottom is made up of two lows and a single neckline.

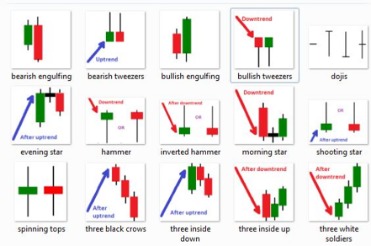

The Doji how to trade double bottom pattern forex is a pattern used in technical analyses of trend reversals in a market. Trading breakouts and fakeoutsBreakout and fakeout trading enable traders to take positions in rising and falling markets. What Are Momentum Indicators in ForexMomentum indicators measure how strong the price change is in the currency pairs. How to Identify a Trend in the Forex MarketIdentifying market trends in forex is also helpful in understanding if your trading strategy is going as per plan and where you can improve.

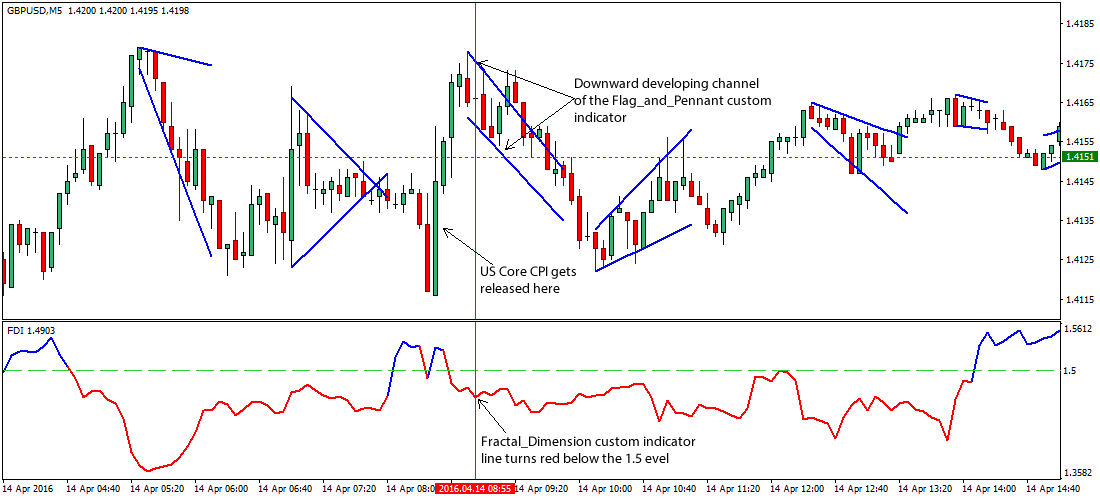

Stock chart continuation patterns:

Notice that the initial trend is bullish but later it gets reversed after the Double Top formation. After the creation of the second top, the price action drops and starts a new bearish trend. When trading in the Forex market, you need to have a close eye on two currencies at the same time. PIP helps you denote the change in a currency pair’s value. All you have to do is to identify the pattern correctly and know the proper levels of when and where to enter and exit a trade.

Then you will love the detailed trading strategies and techniques we are going to talk in this article. We have created an online community for Beginner and pro traders. I positioned the stop loss slightly below the second low, as shown in the chart above. Orders can be placed once the neckline has been drawn and broken. More cautious traders, on the other hand, will hold off on placing a buy order until the neckline has been retested.

Trading Double Tops And Double Bottoms

You can find this pattern in a trending market when a long downtrend comes to an end or in a ranging market where the price consolidates and fails to break below the support line. Price rejected the level with the double bottom pattern and moved up higher. If you were waiting for a confirmation break of the neckline, you would have entered fairly late into this trade.

- Since the Double Tops indicate a bearish trend reversal, the traders are able to make an exit decision well in time as soon as the second top occurs in the market.

- Once it breaks above the neckline, the forex pair continues to trade higher and a bullish trend has started.

- For placing TP, we chose the previous recent high, and we can see how perfectly the price respected our placement.

- Instead, it bounced off the neckline and resumed the overall bearish trend before the first low.

Let us study the Double Bottom patterns trading strategies in more detail using the four-hour chart of the USD/CHF currency pair as an example. The double Bottom is an extremely powerful chart pattern when it is interpreted correctly. If you interpret it incorrectly then it can damage your trading account. You can activate your trades when price action hits the second Bottom, or you can activate trades when price action crosses the Neckline and retests as support. It doesn’t matter where you activate your trade; both of the locations provide a good risk to reward ratio.

Learn more about trading with technical patterns

Since the breakout is opposite to the trend, we confirm the emergence of a new trend. As mentioned, this is pretty much the same situation as the Double Top, but this time the price action starts with a bearish trend, which gets reversed into a fresh bullish move. Today we will discuss two of the most popular chart patterns used in Spot Forex. This is the Double Top and its reversed equivalent the Double Bottom. We will discuss the structure of these two patterns and the potential they create on the chart. Finally, we will show you how to trade the Double Top and Bottom reversal formations using practical examples.

GBP/USD Pierces Through Psychological 1.2000 Level. Further … – DailyFX

GBP/USD Pierces Through Psychological 1.2000 Level. Further ….

Posted: Tue, 07 Feb 2023 08:00:00 GMT [source]

To help you see how https://g-markets.net/ bottom patterns look in reality, we are going to show you two examples. One thing that I see time and time again in retail traders is blindly marrying analysis. No matter what the market conditions are, or what the price action is showing, traders like to stick with their guns until stop loss. For instance, in this XAUUSD chart above – we can see a double bottom formed on the lower support level.

This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information.

Time frames can be measured in minutes, hours, days, weeks, months and years. How to Trade Bullish and Bearish DivergencesBullish and bearish divergences enable you to trade market reversals. How to Short Sell a CurrencyShort selling enables traders to place lucrative forex orders even in a falling market. Here are two examples to show you how to use the Adam and Eve pattern in forex trading. Use a Volume Indicator – As Adam and Even pattern is normally characterized by high trading volume during the pattern’s formation, it is best to add a volume indicator. First Bottom or Top – In a downtrend, the price must make a sharp bottom with a price peak.

Learn all about the Bull Flag pattern, its features, how to identify it in the chart and how to use it correctly when trading on Forex. The buy signal provided by the pattern is more accurate in longer timeframes. Another example of double bottom formations is in the H4 META Platforms Inc chart. Price typically breakout in the direction of the prevailing… A descending triangle forms with an horizontal resistance and a descending trendline from the swing highsTraders can… While trading, you will need to eliminate your idealistic mindset since the pattern will not appear perfect at all times.

It is formed when the downtrend is interrupted at some point, which results in the price action to form a range. When the second Bottom is printed, we can expect the price to print a brand new higher high. Along with double bottom patterns, there can be false breakouts and bullish traps.

Is Your Risk/Reward Enough?

As you can see in the below Image, the market prints the Double Bottom chart pattern, which indicates that the buying trade in this pair. When price action hits the Bottom second time, the market prints the bullish engulfing pattern, which indicates the buying trade in this pair. How to Find The Best Forex Trading SignalsForex trading signals are important market triggers that provide traders with ideal entry and exit price levels in the market. Once the double top pattern is confirmed to be near the resistance level, the pattern is confirmed, and traders can place short or sell orders.

- Both peaks must occur one after the other without much time in between.

- Overall, it is an excellent chart pattern to find entry levels as it gives you double confirmation of the price failing to break above or below a specific price level.

- But there are times when buyers fail to hold their positions, and quotes break through the support line under the selling pressure.

- A while later, the currency pair price corrects itself and starts trading near 1.1 before it makes another bottom at 0.80.

Basing refers to a consolidation in the price of a security, usually after a downtrend, before it begins its bullish phase. Those who have a fader mentality—who love to fight the tape, sell into strength and buy weakness—will try to anticipate the pattern by stepping in front of the price move. Full BioBoris Schlossberg is the co-owner of BK Asset Management and BKForex, as well as a published author.

An appropriate time for the pattern to complete should be at least three months. Finally, I hope you learned something valuable in this ultimate guide on how to trade double bottom pattern. Hence, if we can combine Double bottom pattern with these key levels, we can find a higher probability trade setup. In the sketch above we can clearly see that price broke and closed above the neckline.

Then the price retraces until it finds a resistance level that we call the neckline. In the second phase, the price goes downwards towards the support created early by the first peak. But it fails to break it, and rather rallies to the neckline again. Although the pattern is fairly easy to recognize and can be traded using a basic set of rules, you cannot simply jump into a trade whenever you see two bottoms or tops on the chart.