Contents:

Trading Point of Financial Instruments Limited provides investment and ancillary services to residents of the European Economic Area and the United Kingdom. While each exchange functions independently, they all trade the same currencies. Stay informed with real-time market insights, actionable trade ideas and professional guidance. Take control of your trading with powerful trading platforms and resources designed to give you an edge. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

As the American nations close their days, there is a brief period of rest before the Asian and Australian markets reopen, starting the cycle over again. In addition to Japan and Australia, the rest of Asia starts their markets around this time, as well. China and Singapore are notable nations that come into the market over the next two hours.

“Inter-session flat” strategy

The number of resources traded during Asian market sessions is often very low, making the average pip movements too low to cover the high spreads of Asian currencies. Every trading session or window has the potential to get extremely https://day-trading.info/ busy, but of all the trading sessions, one remains far busier than all others. The London sessions are known for being the times when trading peaks, with approximately 30% of all trades taking place during these time frames.

Additionally, most news and events that impact the US dollar are typically released in the early hours of the New York open. There is high liquidity and volatility in the early hours during the London/New York overlap (1300hrs GMT – 1600hrs GMT), and most assets feature thin spreads. However, volatility and liquidity tend to decrease during the latter half of the New York session.

While not as volatile as the trading that occurs during the London/U.S. Overlap, the former regions provide ample opportunities for professional and seasoned traders. To check for future forex market hours and holidays, click on the date at the top left of the tool. Most short-term intraday traders decide to trade during the second half of the London session. Because during this time, two of the largest financial centers are operational, which increases liquidity in the market.

Trade forex market hours in the UK

The forex market hours are defined trading periods based on what area of the world is awake and the region’s active trading hours. However, combining all these sessions reveals that somewhere in the world is trading forex. Speculators typically trade in pairs crossing between these seven currencies from any country in the world, though they favor times with heavier volume. When trading volumes are heaviest forex brokers will provide tighter spreads , which reduces transaction costs for traders. Likewise institutional traders also favor times with higher trading volume, though they may accept wider spreads for the opportunity to trade as early as possible in reaction to new information they have.

Rivian Q4 earnings preview: Where next for RIVN stock? – FOREX.com

Rivian Q4 earnings preview: Where next for RIVN stock?.

Posted: Mon, 27 Feb 2023 08:00:00 GMT [source]

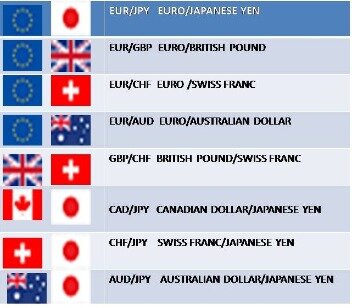

Along with identifying the most popular trading windows to time forex trades, you should also understand the most popular currency pairs that are regularly traded among global forex traders. The more familiar you are with these popular currency pairs, the more effectively you’ll be able to use them in your trading strategy. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Trading.com Trading Hours

The USD is the cue provider during the New York session, and traders can trade all the major pairs such as EURUSD, GBPUSD, USDCHF, USDJPY, USDCAD, AUDUSD, and NZDUSD. The US Federal Reserve is the central bank to watch, as well as major US data such as Nonfarm Payrolls, Trade Balance, GDP, Industrial Production, and Retail Sales. The period when these two trading sessions overlap is the busiest period and accounts for the majority of volume traded in the $6 trillion a day market. I think everyone who’s ever thought about trading in financial markets asked themselves about the working hours of a stock exchange or Forex working hours. Unfortunately, so little attention is paid to this issue during regular training courses which can be found everywhere on the internet or taken at a brokerage company.

Rupee falls 12 paise to 82.77 against US dollar – The Economic Times

Rupee falls 12 paise to 82.77 against US dollar.

Posted: Thu, 16 Mar 2023 11:01:00 GMT [source]

Discover our global FX market hours and when the best time to trade forex is. There are countries such as the US, UK, and Australia that observe Daylight Savings Time . This will also influence the open and closing times of the respective trading sessions. While AvaTrade notifies traders of changes in different open/closing times, it is important to note that due to DST, there will be changes in market hours in March, April, October, and November. Moreover, this is also why the European session open is considered the most liquid and active trading session because a majority of the major currency pairs are traded during this time.

Traders with open positions over weekends should be aware that these positions are susceptible to additional risk when significant events occur during the market closure. The opening and closing times correspond to the current winter time. Once the clocks switch to the summer time, the schedule of the sessions goes 1 hour forward. Investing in or trading financial instruments, commodities, or other assets carries a high degree of risk. You should only in trading or investing if you are fully aware of the potential risk of loosing all your deposited money. Access to the market at all hours can leave traders glued to their charts for longer rather than taking a needed break.

Are there overlaps in forex trading times?

The forex market is one of the only financial markets that have the luxury of remaining open over a 24 hour, 5 days a week period. This is due to the different international timezones and trading being done over a network of computers instead of physical centralised exchanges. This two-hour time frame isn’t as liquid as the U.S. and London overlap but still offers ample opportunities for skilled traders.

Within this period is where the London and U.S. markets overlap, effectively a marriage between the first and second biggest individual forex markets. Nations must find some relative standard to gauge their currencies’ valuation. Since this search for monetary meaning doesn’t stop at one country’s time zone, forex market hours are constantly rolling.

Europe is comprised of major financial centers such as London, Paris, Frankfurt, and Zurich. Banks, institutions, and dealers all conduct forex trading for themselves and their clients in each of these markets. Currency is also needed around the world for international trade, by central banks, the role of continuing bonds in coping with grief and global businesses. Central banks have particularly relied on foreign-exchange markets since 1971 when fixed-currency markets ceased to exist because the gold standard was dropped. Since that time, most international currencies have been “floated” rather than tied to the value of gold.

The forex trading sessions are named after major financial centers and are loosely based on the local “work day” of traders working in those cities. Use the Forex Market Time Zone Converter tool below to view the open and close times of the main forex trading sessions in your own local time zone. Hence, knowing which time of the day the Forex market remains most active is an integral part of becoming a successful trader. The best time to trade the global foreign exchange market is when other traders are active in the market and trading volume remains healthy enough for spreads to remain tight. The FX Market Hours widget shows the opening and closing times of Asian, European and North American trading sessions.

Sudden price changes can occur during this time too, usually because of a major economic or environmental event that drastically influences the value of a currency. PublicFinanceInternational.org helps traders and investors, from around the world, navigate the complex world of online brokers. We spend thousands of hours a year, both researching and testing brokers, to give you unbiased and extensive reviews. To keep the website running, we make money through affiliate commissions and paid advertising, at no additional cost to you. While our partners compensate us for our work, they can not alter our review process, ratings, and recommendations. Trading forex doesn’t have to look like the day trading many traders romanticize in blog posts or news articles.

- But you will have a very difficult time trying to make money when the market doesn’t move at all.

- We will keep this information up-to-date on a best efforts basis.

- Back in August 1971, President Richard Nixon announced the suspension of the gold standard or the convertibility of the dollar into gold.

- Yes, all forex positions can be held over the weekend and major holidays.

- This is when liquidity is at its highest as many Forex market participants prefer trading during this time.

For example, AUD is traded the most actively during the Pacific trading session. Moreover, not all branches of a certain big bank will do these large-scale cross-border transactions. For example, a small branch of the Bank of America in Louisville, Kentucky.

Test drive the thinkorswim platform and practice your trading strategies without putting any real money on the line. Forex trading is available 23 hours per day Sunday through Friday. As the term implies, price swings represent substantial shifts in currency valuations.

However, just because you can trade the market any time of the day or night doesn’t necessarily mean that you should. Most successful day traders understand that more trades are successful if conducted when market activity is high and that it is best to avoid times when trading is light. Knowing the forex market’s operating hours is essential for a trader. You need to know when the forex market opens and closes as well as the four main trading sessions. This four-hour overlap sees the highest trading volume and is a great time for trading opportunities.