Contents:

ETFs allow you to track the price of an underlying asset or index, such as the price of a single cryptocurrency or a “basket” of severaltokens – a convenient way of diversifying your portfolio. They also remove some of the barriers to entry, such as using a cryptocurrency exchange or learning how to store crypto safely. Another appeal is that ETFs are tightly regulated and offered through traditional platforms such as stock exchanges, including NASDAQ and the Toronto Stock Exchange. A bitcoin futures exchange-traded fund issues publicly traded securities that offer exposure to the price movements of bitcoin futures contracts. BITO’s fund managers buy positions in one-month CME bitcoin futures contracts.

There is currently no fully developed infrastructure in place for buying and selling cryptocurrencies. For instance, although certain tokens are offered on specific cryptocurrency exchanges, others are not. However, investors can diversify their portfolios with cryptocurrency ETFs without paying for individual tokens. BITI operates inversely (-1x) to the S&P CME Bitcoin Futures Index, offering an opportunity to potentially profit from its decline. The ETF is tied to bitcoin futures contracts and is rebalanced every day.

Choose an exchange rate

This article will discuss how a cryptocurrency ETF works and the benefits and risks involved in cryptocurrency ETFs. Leverage created by futures contracts can significantly amplify both gains and losses. While there isn’t a spot bitcoin ETF in the U.S., there are bitcoin futures ETFs and ways to invest in ETFs that focus on bitcoin-invested or adjacent companies. These ETFs may hold companies that invest in bitcoin such as Tesla or support mining infrastructure or other technology.

Are bitcoin ETFs worth it?

If you don't want to actively manage your crypto investment, but you want a way to diversify your portfolio with a high-risk, high-reward asset, a Bitcoin ETF is a better option than directly buying Bitcoin.

Instead, they hold Bitcoin futures contracts, and in some cases the shares of companies and other ETFs active in the cryptocurrency space. VanEck Bitcoin Strategy ETF is an actively managed fund that launched in November 2021. XBTF aims to track the price of Bitcoin by investing in BTC futures and may invest some of its assets in Treasuries and cash.

Disadvantages of crypto ETFs for investors

Consent to use personal information may be withdrawn by a client at any time. All information concerning unitholder transactions and their accounts are confidential and must not be disclosed to anyone other than the unitholder or her/his dealer unless https://day-trading.info/ the intended purpose is disclosed. Evolve will use client information only for the purposes identified at or before the time of collection. Evolve’sPrivacy Protection Policygoverns the collection, use and disclosure of personal client information.

When you buy bitcoin directly, there is no fee for holding your coins, no matter for how long. However, you may encounter a fee if you withdraw your bitcoin from an exchange or if you trade your bitcoin for another cryptocurrency. One essential component of cryptocurrencies, decentralization, is sacrificed when they are used in ETFs.

‘No Justification’ for SEC to Deny Bitcoin Trust Conversion Into ETF … – Decrypt

‘No Justification’ for SEC to Deny Bitcoin Trust Conversion Into ETF ….

Posted: Wed, 12 Oct 2022 07:00:00 GMT [source]

Currently, the United States has yet to approve a spot bitcoin ETF, though investors can invest in bitcoin futures ETFs. The difference between the two is a spot bitcoin ETF is backed with actual bitcoin , while bitcoin futures ETFs are backed by bitcoin derivatives. Exchange-traded funds are not a new invention and are common in the financial sector. ETFs can be found to gain price exposure to different assets and industries, including commodities and currencies, or can be set up to focus on companies that are environmentally friendly or focus on diversity. As Bitcoin’s price rose above several thousand dollars, retail and average investors lost the opportunity to invest in Bitcoin directly. Brokerages, responding to demand for investor access to Bitcoin, began to design Bitcoin exchange-traded funds.

Who owns the most bitcoin?

On top of an annual management fee, you’ll need to consider brokerage fees that apply when you buy or sell ETF units. Cryptocurrencies are famous for their volatility and can experience substantial price fluctuations in a short space of time. If the market moves against you, the value of your crypto ETF units could take a sharp dive.

Is bitcoin ETF risky?

Along with offering indirect exposure to BTC, Bitcoin ETFs could pose risks to investors if the fund holds a sizable portion of the futures market. Therefore, investors should be cautious while investing in volatile securities like cryptocurrencies.

Since the issue of the first modern ETF in the 1990s, ETFs continue to grow more popular and are globally among the most sought-after type of investment by retail investors. Besides the inherent volatility involved with investing in Bitcoin, Bitcoin ETFs and funds won’t be a perfect replacement if you want exposure to the largest digital currency. However, there are benefits to selecting an ETF since it can be a workaround for getting Bitcoin’s performance inside your IRA.

How to invest in a cryptocurrency ETF?

Cryptocurrencies are unforgiving – send funds to the wrong address and they are likely lost forever. While investors don’t need to move cryptocurrencies from one address to another, the reputation for difficulty is still off-putting. For example, a bitcoin ETF does not represent BTC ownership but it still offers the necessary price exposure. Moreover, an ETF can be more useful to those who prefer a more passive price exposure, users who are wary of bitcoin, or traders looking to diversify their portfolios conveniently. Many people look toward the United States to get truly excited about a bitcoin exchange-traded fund.

Investing in a futures-based bitcoin ETF such as BITI or BITO is not a direct investment in bitcoin. The funds track CME bitcoin futures, which are contracts speculating on the crytocurrency’s future price, rather than bitcoin itself. Investors should be aware that the price of the ETF could be different to the price of the cryptocurrency itself. The last trading date for bitcoin futures contracts is the last Friday of the contract month.

Internet Security Policy

Keep in mind that some exchanges offer ETFs, but only via private sale . Traditional ETFs often include an extensive range of securities to help achieve diversification. They sometimes include government bonds and debt to mitigate market risk. However, most versions of crypto ETFs only provide access to a limited range of digital currencies. When you also consider the correlation between the performance of Bitcoin and the value of altcoins, this only increases the level of risk. There’s currently limited choice available for anyone wanting to invest in cryptocurrency-related ETFs, although this is rapidly changing.

Some ETFs are only available via private sale from the issuer, and come with certain requirements that leave them out of reach for the average investor. They are typically only available to accredited investors and have a high minimum investment amount, often upwards of $50,000. You can make life easy for yourself by using our guide to find alist of brokers with access to global markets. As such, ETFs are more suited to people looking for a long-term buy and hold investment rather than something to actively trade. Cryptocurrency ETFs are best suited to people who want exposure to cryptocurrency markets, but do not want to or cannot own real cryptocurrency for various reasons. ETFs give you a convenient way of investing in cryptocurrency, but they may not be the most cost-effective.

BITO

Nobody should invest more than they can afford to lose, and it’s always a good idea to consult a financial advisor prior to any investment decision. Here’s how it works in the case of the ProShares Bitcoin Strategy ETF . As the contracts near expiration, the fund gradually sells them admiral markets review 2021 and buys longer-dated contracts. Exchange limitation – it is easy to exchange your ‘physical’ digital assets that you directly hold. If you have some Bitcoin in your wallet, you can easily swap it for some Ether or Litecoin or any other asset supported on your platform of choice.

- A day after the first Bitcoin futures ETF started trading in the US, Bitcoin hit a record high above $66,000.

- Even as digital coins and tokens become increasingly popular, they are becoming more complex.

- The U.S. Securities and Exchange Commission has refused to allow a new, untested public crypto-focused ETF.

- Keep in mind that ETFs only trade during market hours, while cryptocurrency trades 24/7.

While almost anyone can open a Coinbase account, for instance, not everyone is comfortable doing so. Others may be restricted to buying and selling securities in their traditional brokerage accounts for various reasons. If the price of BTC is rising, BITO uses its gains to add to a pool of funding held in cash and Treasuries. If the price of BTC falls, it takes funds from the pool to pay for the losses on futures contracts. BITI attempts to accomplish this goal by returning the inverse of the S&P CME Bitcoin Futures Index for a single day at a time.

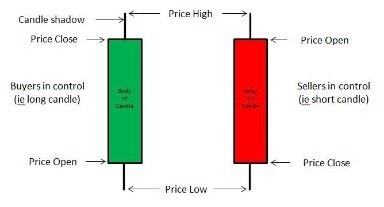

But, unlike mutual funds, ETFs can be bought and sold anytime during market trading hours. Bitcoins ETF allows two investors to reach a contractual agreement to buy or sell Bitcoin at a given price someday in the future. To create a Bitcoin ETF or any crypto ETF for that matter, a management company will acquire the actual coins from the market.

Defined Outcome ETFs Catch a Wave – ETF.com

Defined Outcome ETFs Catch a Wave.

Posted: Fri, 23 Dec 2022 08:00:00 GMT [source]

Blockchain is the central technology behind cryptocurrencies, and there are plenty of companies involved in its development and utilization. There are several ETFs made up of those companies, which can give investors exposure to crypto technology without investing directly in the currencies themselves. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

What is the difference between bitcoin and bitcoin ETF?

For regulatory reasons, Bitcoin ETFs don't invest directly in Bitcoin. Rather, they are based on financial products, such as Bitcoin futures contracts, or other investments that correlate to the price of the cryptocurrency. (Similar vehicles exist for other coins.)