Contents:

The goal is to profit from a narrow range of movement in the underlying asset. Variations if the butterfly include the condor, iron butterfly, and iron condor. The option-adjusted spread measures the difference in yield between a bond with an embedded option, such as an MBS, with the yield on Treasuries. It is more accurate than simply comparing a bond’s yield to maturity to a benchmark. By separately analyzing the security into a bond and the embedded option, analysts can determine whether the investment is worthwhile at a given price.

- When traders engage in spreads trades, they buy one security and sell another with identical features as a unit simultaneously.

- You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

- The bid-offer spread is a representation of the supply and demand for an asset.

If the trader is assigned the call early, resulting in a short stock position prior to the ex-dividend date, the trader could be liable to pay the dividend. A short put option is more likely to be assigned early if the put is ITM and has lost most or all of its time value. Spreads are the differences in prices, interest rates, or returns of related quantities such as stocks, bonds, futures contracts, options, and currency pairs. However, their meaning varies depending on the type of trading and the asset or security traded. Although different types of futures spreads exist in traditional finance, the most common in cryptocurrency markets is the intramarket spread, also called a calendar spread. For example, you have bull and bear calls which occur when the investor takes a short position on a security.

What is Spread Trading?

This is why the bull call spread is considered a limited risk strategy. If XYZ stock rises to $60 per share, the call option with the strike price of $45 per share would be in the money and have a value of $15 per share ($60 market price – $45 strike price). The call option with the strike price of $55 per share would also be in the money, but with a value of only $5 per share ($60 market price – $55 strike price). The net profit for the investor in this case would be the difference between the two options, or $10 per share.

From the RFQ Builder, select the underlying asset you want to trade from the “Pre-defined Strategies” section. As mentioned, OKX provides various tools to get started with spread trading and to further mitigate risk. We’ll also be adding more features to simplify spread trading over the coming weeks and months, and will update this tutorial accordingly. Now that we know how currencies are quoted in the marketplace let’s look at how we can calculate their spread. Forex quotes are always provided with bid and ask prices, similar to what you see in the equity markets.

How to Execute a Spread Trade

However, its accuracy, completeness, or reliability cannot be guaranteed. Commissions, taxes, and transaction costs are not included in this discussion but can affect the final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies. Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.

Whether the market increases or decreases does not dictate the amount of return. If the price of Vodaphone fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically. In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher. In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. In the stock market trade, a deposit of as much as £193,000 may have been required to enter the trade.

If the long https://trading-market.org/ is trading at $1.25, it could potentially be sold to close and the trader would experience a $0.50 profit . If the short call expires worthless and the trader holds the long call to the expiration, and it too expires worthless, then the result is a 100% loss on the spread , plus transaction fees. Treasury securities focuses on the difference in yields between different bonds based on their time to maturity. The yields for the various key maturities in the Treasury bond market, ranging from three months to 30 years, when plotted on a chart are known as the yield curve.

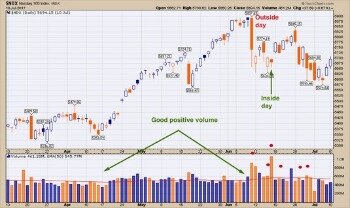

Intermarket spreads

It expands on the topics mentioned above, giving you a better understanding of and insight into what spreads really are and, more importantly, how to place and manage your spread trades. Obviously, the risk taken for the difference in price among related contracts is far less than the price risk taken in an outright speculation. This is because related futures will tend to move in the same direction. And keep in mind that you can trade 10 times as many spread contracts as you can outright futures contracts. In our example you would achieve a 115 times higher return on your margin.

In many cases, options spreads allow traders to theoretically define their risk. That is, they know how much they stand to profit or lose before entering the spread trade. While risk may be typically defined in advance, profit potential may be usually limited as well. Equity index and ETF strategies are also sometimes called pairs trades. Pairs trading generally requires two things that have a high correlation—that is, two indexes or ETFs that have some historical price relationship or pattern.

Key Takeaways – Spread Trading

The spread trading explained for beginners requirement to sell the option can also be very large. It may be helpful to think of a spread like a bridge that connects two options and, when combined, the spread can offset some of the risk of holding a single option. It can be easier to exploit price discrepancies via the spread than to predict price movements in each underlying security or contract.

For some assets, like shares, providers will not use a spread but will charge on a commission basis – other assets might feature a mixture of the two. A spread in trading is the difference between the buy and sell prices quoted for an asset. The spread is a key part of CFD trading, as it is how both derivatives are priced. These great advantages make spread trading the perfect trading instrument for professional traders and beginners. Officially, Intramarket spreads are created only as calendar spreads.

- Futures spreads are formed when a trader takes opposite positions in the futures market at the same time — i.e., buying one futures contract and selling another.

- 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

- Some types of commodity spreads enable the trader to gain exposure to the commodity’s production process, specifically the difference between the inputs and outputs.

Spreads – because they are executed as a unit – are either bought or sold. It depends on the investor’s needs as to whether he believes he will benefit from a wider or narrower spread. There are a variety of types of spreads and spreads with names; the most common types of spreads are option spreads and inter-commodity spreads. A credit spread reflects the difference in yield between a treasury and corporate bond of the same maturity.

The use of leverage works both ways, of course, and herein lies the danger of spread betting. As the market moves in your favor, higher returns will be realized; on the other hand, as the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast.

Click Buy to buy the spread (i.e., long the near contract and short the far contract), or Sell to sell the spread (i.e., short the near contract and long the far contract). You think that Apple’s share price will go up, so you open a long position at £3 per point. Remember, as you’ll be trading with leverage, you only need to pay a percentage of the total position’s full value. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Strange Ancient Burials Found in Southern Israel – Archaeology – Haaretz

Strange Ancient Burials Found in Southern Israel – Archaeology.

Posted: Thu, 30 Mar 2023 09:22:00 GMT [source]

Credit spread trading can be a complex and risky endeavor, as it involves predicting changes in interest rates or the creditworthiness of the bonds being traded. This trade profits if the underlying asset price increases, and the maximum profit is achieved if the underlying asset price is at or above the higher strike price at expiration. On the RFQ Board, you’ll see quotations from your chosen counterparties under the “Bid” and “Ask” columns. The figures displayed are price differences for buying and selling your chosen instruments’ spread. You’ll also see the creation time, the time remaining before your quotes expire, the position’s status and quantity, and the counterparty making the quote.

Someone who is bullish on the S&P might buy S&P futures and sell Nasdaq futures. Let’s say S&P 500 futures, which are the index times a multiplier, are priced at about $100,000, and Nasdaq 100 futures are priced at about $50,000. For every S&P futures bought, two Nasdaq futures would be sold, to create the spread trade. At the expense of the market maker, an arbitrageur bets on spreads from two different companies. When the top end of a spread offered by one company is below the bottom end of another’s spread, the arbitrageur profits from the gap between the two. Simply put, the trader buys low from one company and sells high in another.

The principle is the same — if you’re right, you win, if you’re wrong, you lose — but this time, because you’ve bet the price will drop, you profit if the share price goes down. 1An in-the-money option has value that can be realized through exercising the contract. If the shorter-term option “decays,” or loses value faster than the longer-term option, the spread may be worth more, and the trader may be able to close out the spread for a profit. Transaction costs are higher in futures spreads, as each leg of the trade using futures has a cost. An investor can create different combinations of call and put options with different exercise prices and expirations. Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses.

Spreads can also be constructed in financial markets between two or more bonds, stocks, or derivatives contracts, among others. For example, a trader might buy a July wheat futures contract and sell a September wheat futures contract, hoping to profit from the difference in price between the two delivery months. There are several types of spreads that traders can use in futures markets, including calendar spreads, inter-commodity spreads, and intra-commodity spreads. This is a bullish strategy that involves buying a call option with a lower strike price and selling a call option with a higher strike price on the same underlying security. Traders and investors can execute spread trades using a variety of financial instruments, including stocks, options, futures, and currencies. Of course, you can enter spread trades manually by taking opposite positions in the futures market, or the futures and perpetual swap market.